Credit Card Surcharging

What Is A Credit Card Surcharge?

A surcharge is an additional fee added when a card is used for payment. It's also known as a checkout fee. As a result of a legal settlement, merchants have been allowed to surcharge since 2013.

What Are The Rules Around Credit Card Surcharging?

V/MC rules currently allow a 3% surcharge on credit card payments. Surcharging is not allowed on debit cards, and it's not allowed where it's prohibited by state laws.

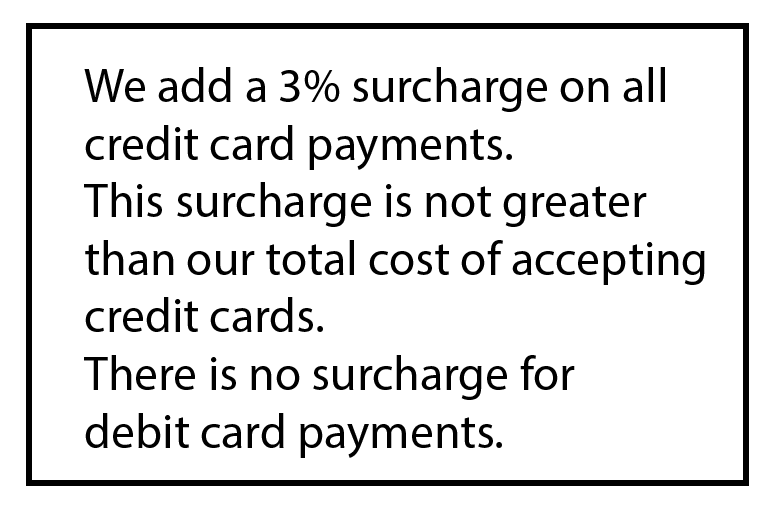

The surcharge must be reported in the network authorization and settlement by the credit card processor, and businesses must disclose their surcharging policy at points-of-entry and checkout.

Credit Card Surcharging Signage Example

Is Surcharging Right For My Business?

Before choosing to surcharge, think about:

- the impact on the customer experience.

- what your competition is doing.

- what information must be disclosed to customers, and how.

- is your payment processing solution compliant.

Payment Processing Solutions

Surcharging can only be done with compliant payment solutions provided by your payment processor.

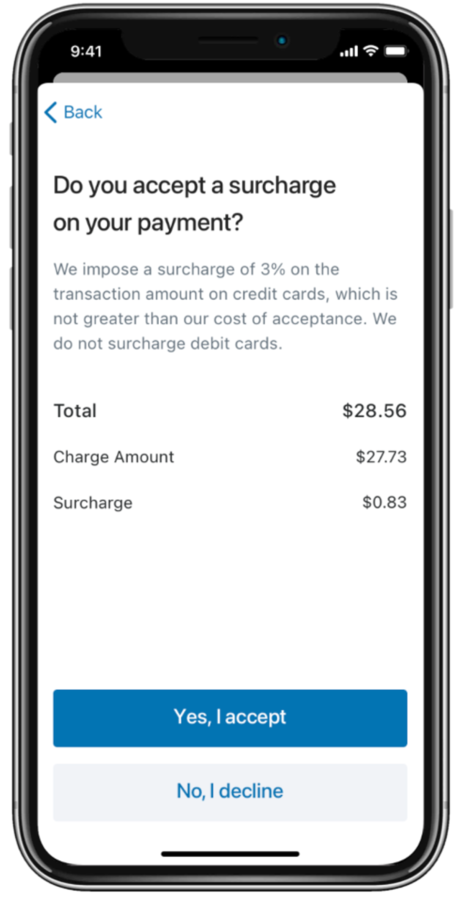

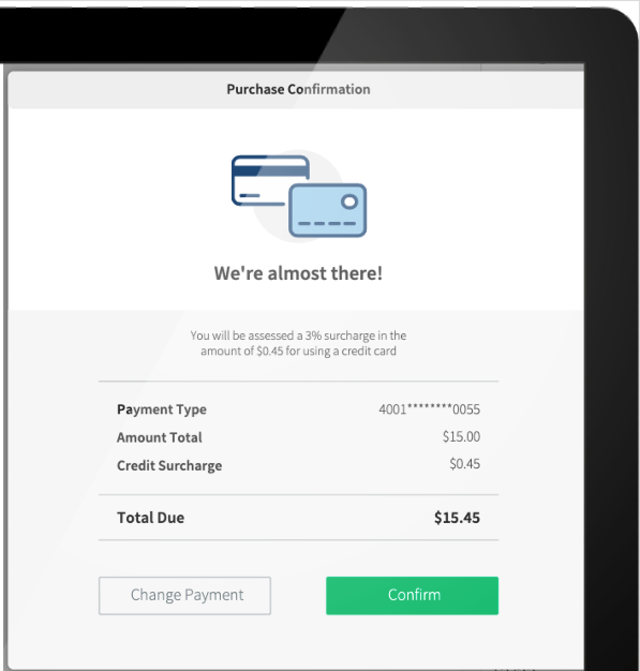

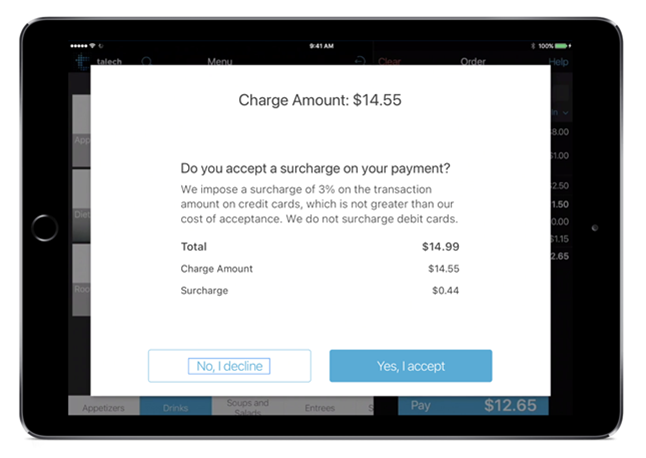

Our surcharging solutions work seamlessly in-store, online, and via mobile by automatically blocking surcharges on debit and meeting all card network reporting requirements, ensuring 100% compliance.

talech Mobile

The talech Mobile app gives you everything you need to run your business on the go.

- Process payments on your smart phone.

- Send e-invoices and collect online payments.

talech Terminal

talech Mobile POS on the Ingenico Axium smart terminal.

- Mobile POS software with a built-in card reader and printer.

- WiFi and 4G connectivity

- Send e-invoices and collect online payments

Converge Payment Gateway

E-commerce, Mail Order / Phone Order, In-Store, and Mobile.

- Hosted payment page

- XML API

- Check.JS

- Buy button

- Virtual terminal

- E-invoicing

talech POS

talech POS is a scalable cloud-based POS solution for retail, restaurant, and service businesses. talech is affordable, easy to set-up and use, works on both iPad and Android registers.

- mobile

- retail

- restaurant

- services

- online ordering

- e-invoicing

Why Choose Burlington Bank Card?

Secure and reliable payment processing, excellent service, low fees and no contracts.

| What to look for? | Burlington Bank Card |

| Fees | Transparent interchange plus pricing or pass on the card fees with surcharging |

| Security | Registered elavon payments provider since 2008 |

| Compliance | Full-service pci compliance and 100% compliant surcharging |

| Support | 24/7 support and personal service |

| Payment Solutions | Innovative and user-friendly payments hardware and software for both in-person and online |

| Funding | Fast, reliable deposits in 1-2 days or same day |

| Contracts | No contracts no cancellation fees |

Credit Card Surcharging Pricing

| Credit | Cardholder Pays 3.00% Surcharge |

| Debit | Merchant Pays 1.00% + $0.25 |

| Monthly Service | $25.00 per month |